Market Overview and Localization Breakthroughs in China's Aluminum Electrolytic Capacitor Industry

1. Accelerated Localization

China’s aluminum electrolytic capacitor industry is experiencing rapid localization, especially in core components like electrode foil and manufacturing equipment. As of 2020, the average price of domestically produced capacitors was only RMB 0.21 per unit, much lower than those from Japan and South Korea. The COVID-19 pandemic, raw material shortages, and rising energy prices have prompted a reshuffling in the industry, driving client resources toward large-scale Chinese manufacturers. Around 70 domestic companies now produce over 100 million units annually, supported by increasingly complete supply chains.

2. Global Manufacturing Shift to China

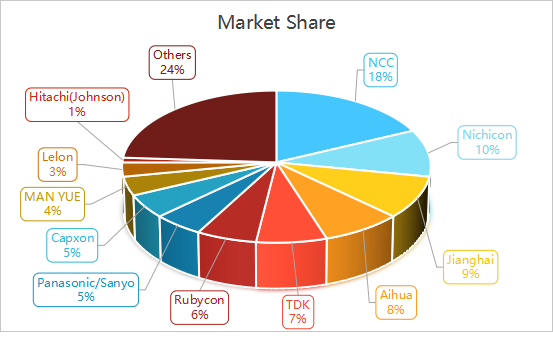

With downstream industries such as home appliances, automotive electronics, and telecommunications relocating to China, international giants like Nichicon, NCC, and TDK have established production bases in the country. Consequently, China has become a global hub for aluminum electrolytic capacitor manufacturing.

3.Electrode Foil: Core Material Market Analysis

3.1 Market Size and Growth

Formation foil, the dominant type of electrode foil (about 95% share), reached RMB 16.62 billion globally in 2021 (+25% YoY), rising to RMB 18.2 billion in 2022. It is projected to grow to RMB 23.54 billion by 2026 at a CAGR of 7.2%. However, labor, aluminum, and energy cost increases are putting pressure on manufacturers.

|

Region |

Product Positioning |

Application Areas |

Pricing Competitiveness |

|

Mainland China |

Primarily Mid-to-Low-End |

Consumer Electronics, Home Appliances, New Energy Infra |

Ultra-competitive (≤ RMB 0.21/unit) |

|

Japan |

High-End (Automotive/Industrial Grade) |

Automotive, Precision Instruments, Rail Systems |

Premium Pricing Strategy |

|

Korea / Taiwan |

Mid-to-High-End |

Telecom Equipment, Industrial Control, Power Electronics |

Moderate (Balance of Cost and Reliability) |

3.2 Localization Bottlenecks

Although mass production capabilities have advanced, high-end etched foil still relies heavily on imports. Japanese companies dominate high-purity electrode foil, particularly for automotive and industrial use.

3.3Competitive Landscape and Product Segmentation

NCC and Nichicon lead globally across multiple capacitor segments due to high quality. Chinese leaders Jianghai and Aihua have risen to third and fourth globally, driven by cost competitiveness and growth in the new energy sector. These firms are increasing investment in emerging areas like renewable energy.

4.Challenges and Opportunities

4.1 Short-Term Challenges

Raw Material Volatility: Aluminum price fluctuations (e.g., Q1 margin for electrolytic aluminum reached RMB 3,521/ton) and high energy costs reduce profit margins.

Lag in High-End Capacitors: Automotive-grade and low-ESR capacitor localization rates are under 30%.

Underdeveloped Solid/Hybrid Capacitors: High failure rates and low adoption hinder premium application penetration.

4.2 Growth Drivers

Emerging Sector Demand: New energy and AI sectors are fueling demand for high-performance capacitors.

Government Support: Policies are encouraging industrial upgrades and infrastructure investments.

5.Future Trends and Outlook

5.1 Technology Trends

Miniaturization: Capacitors are becoming smaller and more compact.

High-Performance Electrode Foil: Focus is on reducing energy loss and supporting 800V fast-charging and energy storage.

Ripple Current & Longevity: Demand is rising for capacitors with higher ripple current, better heat resistance, and longer life.

5.2 Capacity Optimization

Regional Relocation: Electrode foil production is shifting to energy-rich, low-cost regions (e.g., western China) to reduce power expenses.

7.Conclusion

With scale advantages and mature industrial clusters, China dominates the global mid-to-low-end aluminum electrolytic capacitor market. The next wave of growth hinges on breakthroughs in high-end electrode foil technology—especially for automotive applications—and seizing opportunities in booming sectors like new energy and AI.